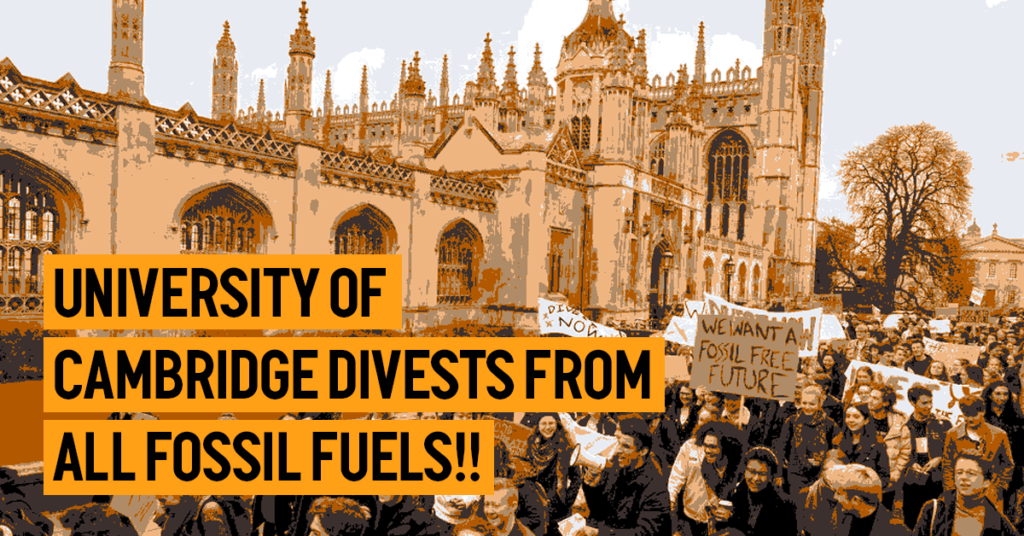

After a five-year battle over its response to the climate crisis, the University of Cambridge has committed to remove all direct and indirect investments in the fossil fuel industry from its £3.5bn endowment fund by 2030. The Cambridge University Endowment Fund (CUEF) is the largest of any higher education institution in Europe.

Cambridge has also outlined plans to divest from any public equity managers focused on “conventional energy” by December 2020, and to “allocate significant capital” to renewable energy by 2025.

During his start of term livestream address on October 1st, the Vice Chancellor will announce that Cambridge will be divesting from fossil fuels and not accept funding from sources that are incompatible with its sustainability ambitions.

The decision marks a major break with the energy sector; Cambridge has held close financial and research ties with BP, Royal Dutch Shell, and other fossil fuel companies for at least 20 years.

In March 2019, members of the student-led divestment campaign, Cambridge Zero Carbon, coordinated a democratic motion backed by 324 Cambridge academics calling on the University to produce fully-costed strategies for divestment. In response, the University commissioned a report authored by Dr Ellen Quigley, Emily Bugden, and Cambridge Chief Financial Officer Anthony Odgers.

As a result of the divestment report, Cambridge’s Investment Office has come to the decision to remove their investments from fossil fuels across all asset classes by 2030.